What Are the Benefits of a Physician Loan?A C

Starting or growing a medical career comes with huge re...

Saturday and Sunday – CLOSED

support@nationalmedicalfunding.com

Dealing with a huge, unexpected medical bill is incredibly stressful for any family. When your health insurance leaves a large gap, getting quick cash becomes the main priority. A personal loan often appears to be the simplest form of healthcare financing available.

However, borrowing money is never a decision to take lightly. A personal loan offers rapid solutions but locks you into a serious financial commitment. This simple guide from National Medical Funding breaks down the clear benefits and real financial risks. We want you to make the smartest choice for your long-term financial health.

The biggest advantage of a personal loan is the speed of access to funds. In a medical emergency, time is critical, and waiting for funding is not an option. You can apply online and often receive approval quickly, with funds disbursed to your bank account within days.

Furthermore, personal loans have fixed terms and interest rates, unlike volatile credit cards. Your monthly payment remains stable for the entire loan period. This predictable structure simplifies budgeting and reduces stress as you recover from your medical issue.

The cash goes directly to you, the borrower, giving you total control over its use. You can pay the primary bill, cover deductibles, purchase necessary prescriptions, or fund recovery travel costs. This flexibility is a huge benefit of this medical financing method.

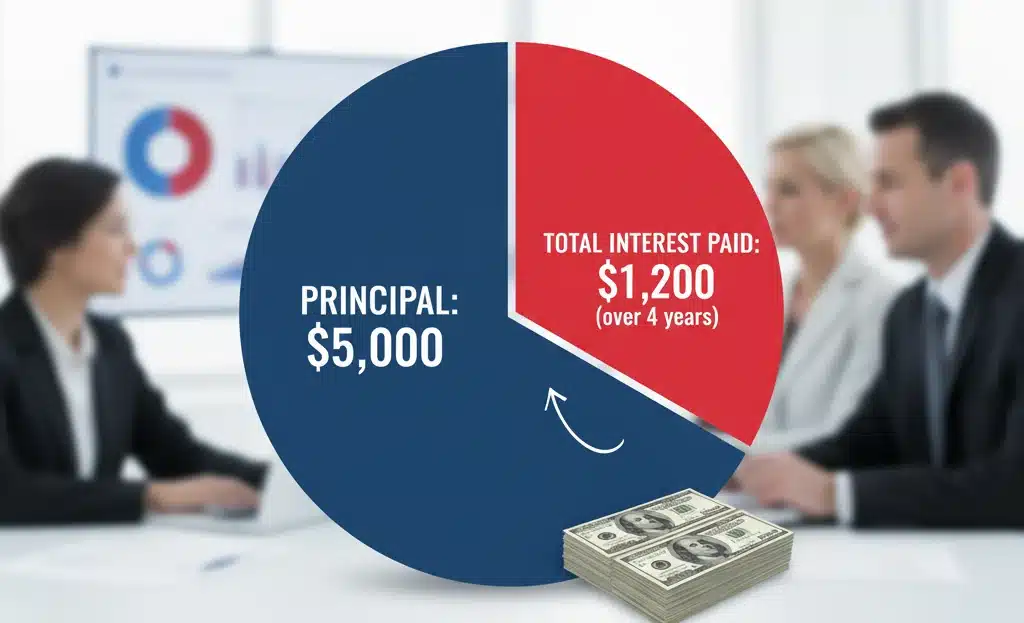

The downside is that a personal loan will absolutely cost you more than the original medical bill. This is because you must pay the principal, plus all the accumulated interest and lender fees.

Always look at the Annual Percentage Rate (APR), not just the interest rate alone. The APR is the true annual cost, as it includes all mandatory fees. For many, rates can range significantly, from 11% up to 30% APR.

Many lenders charge a processing or origination fee, typically 2% to 5% of the loan total. They often deduct this fee upfront before sending the cash. This means you owe money on a principal amount that you never fully received. We offer more detailed advice on evaluating these potential charges in our resource guide. You must understand all the financial jargon before signing for any healthcare loans.

Feature | Personal Loan | Hospital Payment Plan |

Interest Rate | 11% – 30% APR | Often 0% or very low |

Speed | Very Fast (1-3 days) | Slower (requires setup) |

Credit Check | Hard Inquiry (score impact) | Usually Soft or None |

Funds Use | Flexible (Cash) | Restricted (Provider Bill Only) |

Applying for a personal loan requires a “hard inquiry” on your credit report. This action causes a small, temporary drop in your overall credit score. If you plan to apply for other credit soon, this timing could be inconvenient.

A larger issue is the loss of negotiation power with your hospital or provider. Hospitals are often willing to discount bills for quick, lump-sum payment or financial hardship.

Once the loan money pays the provider, that crucial negotiation window is closed forever. Therefore, you should always negotiate the bill down first, then borrow only the reduced amount needed. You can check our detailed guide on evaluating loan contracts to avoid costly mistakes: Evaluating the True Cost of Your Term Loan (Fees, Terms, and Flexibility).

The length of time you take to repay the debt is a critical factor in the total cost. A longer term, such as six years, makes the monthly payment smaller and easier to manage.

However, a longer term also means you pay thousands more in total interest to the lender. Always choose the shortest repayment term you can still comfortably afford without straining your budget.

Your personal credit score dictates the interest rate you are offered. Excellent credit gets you the lowest APRs, while a lower score means much higher rates. It pays to check your credit before applying for any significant medical financing.

A personal loan is only one option, and it might not be the best one for your situation. Many hospitals offer interest-free payment plans directly to patients.

These hospital plans are almost always cheaper than high-interest personal loans. They do not involve a hard credit check and avoid any interest charges completely. Always ask the hospital first about their financial assistance programs.

Other alternatives include medical credit cards, but these often have high deferred interest. Always explore grants or state-specific programs as non-loan options before taking on debt.

Taking on new debt requires a close look at your existing monthly budget and expenses. If the new personal loan payment feels stressful, the debt may be too large for your current income.

You must calculate your Debt-to-Income (DTI) ratio to ensure the payment is manageable. Taking on debt you cannot comfortably afford is the fastest way to ruin your credit and financial health.

For families with lower incomes, high-interest personal healthcare loans may be unavailable or simply too expensive. These families have unique needs and should focus on specialized assistance programs.

National Medical Funding believes everyone deserves clear access to affordable care solutions. Sometimes, the right answer is not a loan but assistance.

If you are struggling with low income or high medical debt, look for non-loan resources first. Many community organizations and state programs exist to help negotiate or settle bills.

We have gathered resources specifically tailored to help those who cannot afford high-interest borrowing. Learn about vital aid options and assistance programs by reviewing our guide: Low-Income Medical Financing Options.

Ultimately, you need to use a personal loan as a strategic tool to solve a problem, not create a worse one. Make sure the comfort of quick cash doesn’t blind you to the long-term cost of the debt. Review the table below for a quick summary.

Loan Cost Factor | What to Look For | Why it Matters |

APR | The single highest percentage number. | Includes all fees; this is the real cost. |

Origination Fee | Percentage of the loan (e.g., 4%). | Reduces the cash you actually receive upfront. |

Prepayment Penalty | Any fee for paying off the loan early. | Limits your financial freedom to clear the debt fast. |

Starting or growing a medical career comes with huge re...

Finances are the heartbeat of every successful medical ...

Fuel your medical practice’s growth with financial solutions tailored to your needs. We’re here to support independent practitioners and group practices with strategies built for success.

Mon Fri: 8:00am – 6:00pm

Saturday: Closed

Sunday: Closed

Copyright © 2025 National Medical Funding