Mastering Your Practice’s Financial Pul

Why Financial Pulse Matters in Modern Healthcare ...

Saturday and Sunday – CLOSED

support@nationalmedicalfunding.com

If you run a medical practice, time is always money—but when you need funding for new equipment, staffing, or simply to bridge a cash-flow gap, time feels like a ticking clock. You can’t wait weeks for a traditional bank loan. You need funds now. That’s why quick medical financing options, often promising funds in 1 to 3 days, have become so popular with busy healthcare professionals.

However, speed comes with very specific rules. To get approved that quickly, you must tick every box on the lender’s checklist. This post is your definitive guide to understanding the exact eligibility requirements that healthcare lenders prioritize for lightning-fast approval. We’re going to show you how to prepare your application package perfectly the first time, ensuring your cash is ready when you need it most.

For quick healthcare loan approval, your credit score is the number one accelerator. Lenders view it as the fastest way to assess your financial reliability and risk. For both personal loans for healthcare and business financing, a strong score signals that you are responsible and trustworthy.

While the absolute minimum score varies, for the fastest funding and the best interest rates, healthcare finance companies generally look for scores of 680 or higher. A score in the 700s is gold. If your score is lower, you might still get approved, but it will likely take longer and cost you more in interest. Make sure you check your personal credit score and your practice’s business credit score before you even start the application process.

Fast funding is almost always reserved for established practices. New clinics or startup ventures often require more extensive due diligence, which slows the process way down. Lenders need to see a track record of stability and proven revenue generation.

The magic number most healthcare lenders look for is a minimum of two years in business. Some may go as low as one year, but two years of successful operation with a positive cash flow significantly increases your chances of 1-3 day approval. This operational history proves that your business model works, reducing the risk for the lender.

Quick approval depends entirely on the lender’s confidence that you can repay the loan easily. This confidence is built on the consistency of your practice’s monthly revenue. They don’t just look at the total income; they analyze the stability of that income stream.

Lenders typically require proof of a minimum gross monthly revenue, often starting around $10,000 to $15,000, and sometimes higher for larger loan requests. This is verified through your recent business bank statements. For ultra-fast decisions, some healthcare finance companies rely on daily bank deposits or credit card receipts as proof of consistent cash flow.

The fastest way to slow down a loan is to submit incomplete or confusing paperwork. The goal for quick funding is minimal documentation, but that documentation must be perfect and ready to go. The less time the underwriter spends chasing down missing papers, the faster you get your money.

For a fast healthcare loan, you generally need to have digital copies of the last three to six months of business bank statements, a valid business license, and personal identification for all principal owners. For larger amounts, recent business tax returns might also be required. Having these prepared in a single, clean folder is a non-negotiable step for 72-hour funding.

The Debt-to-Income (DTI) ratio is a crucial metric that shows the lender how much of your current income is already dedicated to paying debts. A high DTI suggests you might be stretched thin, making the lender wary of adding a new medical financing payment.

Lenders prefer a DTI ratio that demonstrates plenty of room to take on the new debt. Typically, they want to see your total monthly debt payments (including the new loan) consume no more than 40-50% of your total gross income. If your DTI is high, you might consider consolidating existing, high-interest obligations before applying for new funds. If you’re exploring options like a personal loan for healthcare needs, understanding how your personal financial health plays into the application is essential. You can learn more about specific types of financing for individuals here: https://nationalmedicalfunding.com/personal-loans-healthcare/.

For healthcare lenders, the purpose of the loan directly influences the risk assessment and speed of approval. Loans for working capital, minor equipment purchases, or inventory tend to be approved faster than loans for major real estate acquisitions or large, speculative expansions.

When you apply, clearly state the specific use of the funds. Are you covering payroll? Buying a new ultrasound machine? If you are seeking funds for specialty services, such as elective medicine, many healthcare finance companies offer dedicated products. Clarity and a reasonable request amount relative to your practice’s size speed up the process dramatically. You can explore financing options designed for elective services like cosmetic procedures here: https://nationalmedicalfunding.com/elective-med-loans/.

The fastest loans are often unsecured, meaning you don’t have to pledge equipment or property as collateral. This eliminates the time-consuming appraisal and valuation process, which is a major bottleneck in traditional lending.

While unsecured loans are quicker, they usually require higher credit scores and stronger revenue proof because the risk is higher for the lender. If you opt for a secured healthcare loan to get a lower interest rate or a larger amount, be prepared for the process to take several extra days, as the lender must legally verify the value of the assets you are offering as security. The choice between speed and cost is yours to make, but quick funding generally means unsecured financing.

Your business bank account activity tells an important story about the quality of your revenue. Lenders look for things like high numbers of returned checks, frequent overdrafts, or inconsistent deposit patterns. These factors are huge red flags that immediately halt a fast application.

For quick approval, the bank statements you submit should demonstrate clean, consistent, and positive daily activity. No lender wants to fund a business that appears to be struggling with routine cash management. This financial hygiene is critical and serves as primary evidence of your practice’s reliable medical financing health.

To truly achieve 1-3 day funding, you must treat your application as a one-shot deal. Any back-and-forth communication adds hours, or even days, to the process. Use a simple checklist to ensure everything is perfect before you click “submit.”

Requirement Category | Specific Item Checklist | Importance for Speed |

Credit | Personal FICO Score $\geq 680$ | Highest |

Business History | $\geq 2$ Years in Business | High |

Revenue | Last 6 Months Bank Statements (Clean) | Highest |

Documentation | Photo ID, Business License, Tax ID (EIN) | Essential |

Financial Health | Low DTI Ratio (Ideally below 50%) | High |

Getting your healthcare loan quickly is a matter of preparation. Eliminate the lender’s need to ask follow-up questions, and you clear the path for rapid approval.

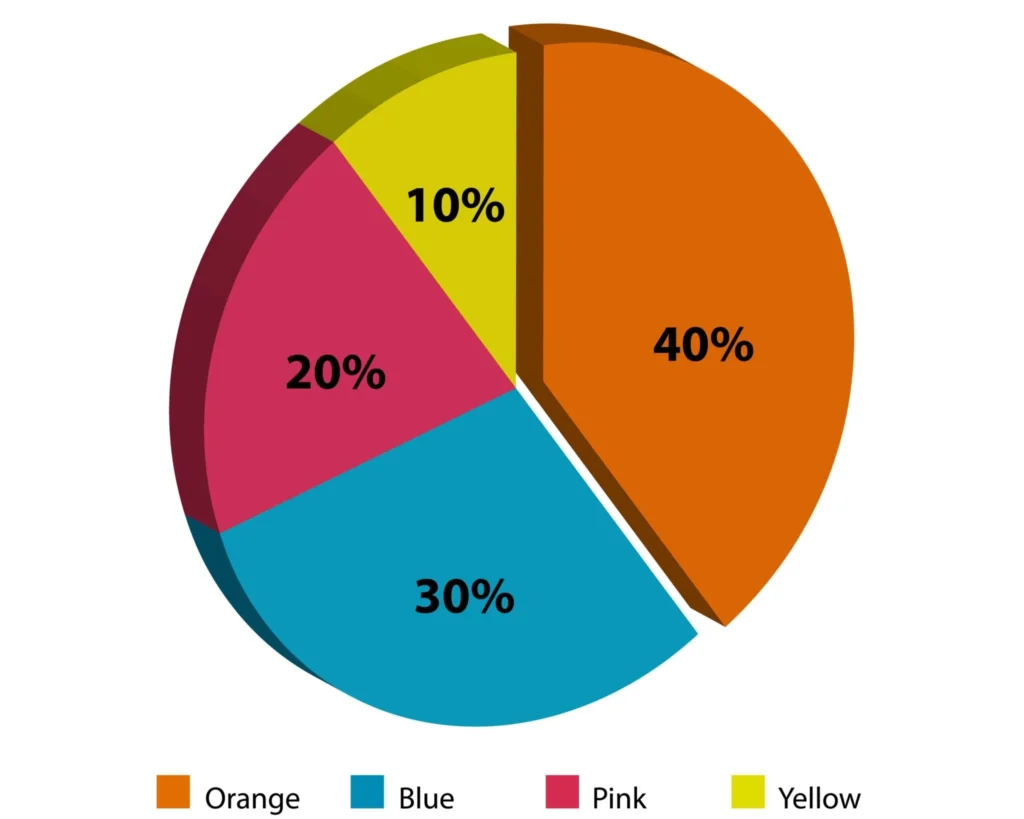

To help you understand where to focus your effort for the fastest approval, here is a breakdown of the two most common reasons for a delay in medical financing applications. As you can see, the data you provide about your financial history is the biggest driver of funding speed.

Q: Will a soft credit pull delay my application?

A: No, a soft pull does not impact your score and is often used by healthcare lenders for pre-qualification to speed things up.

Q: Is it faster to get a secured or unsecured loan?

A: Unsecured loans are generally faster because they skip the collateral appraisal step.

Q: How fast is “quick” funding really?

A: “Quick” means approval often within 24 hours and funds disbursed within 1-3 business days.

Q: Can I use quick financing for any medical expense?

A: Yes, most general healthcare loan products offer flexible use for working capital, equipment, or even inventory.

Obtaining quick healthcare financing in 1-3 days is a completely realistic goal, but it demands military-level organization and strong financial health. You are essentially asking the healthcare finance companies to trust you based on a very brief look at your practice.

By prioritizing a clean credit history, maintaining robust and consistent revenue, and submitting a perfect application package on day one, you remove the friction that causes delays. Focus on these core requirements, and your practice will secure the capital it needs, right when it needs it.

Would you like me to find a list of current interest rates for quick healthcare lenders so you can estimate the cost of a new healthcare loan?

Why Financial Pulse Matters in Modern Healthcare ...

For many doctors and healthcare professionals, one of t...

Fuel your medical practice’s growth with financial solutions tailored to your needs. We’re here to support independent practitioners and group practices with strategies built for success.

Mon Fri: 8:00am – 6:00pm

Saturday: Closed

Sunday: Closed

Copyright © 2025 National Medical Funding